Giving details of meeting the Local-To-Global aim set by Prime Minister Narendra Modi, Finance Minister Nirmala Sitharaman revised the investment limit of MSMEs and introduced an additional criteria of turnover by revising their definition.

The new definition will help MSMEs’ seamless expansion, which is vital for the India to become a highly self-reliant and globally competitive, country.

She said this was a long-pending demand from the sector.

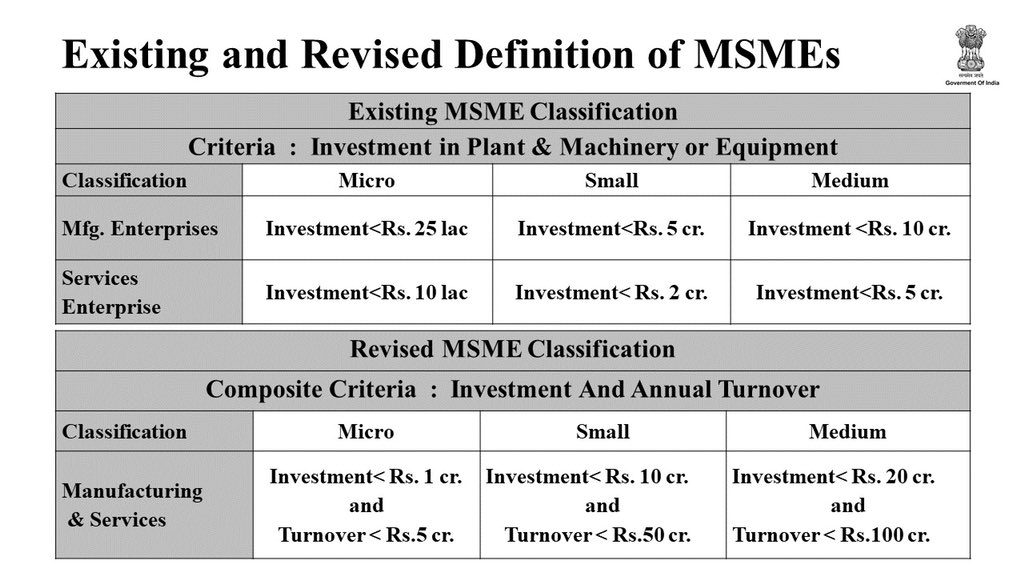

Sitharaman said the new definition removes the difference between manufacturing-based and service-based MSMEs. It also introduced the adding of turnover to the scale of investments to define an MSME.

The following table explains the exisiting and revised definition of MSMEs:

Under the new definition, manufacturing and services firms with investments up to Rs 1 crore and turnover up to Rs 5 crore will be classified as micro enterprises, Sitharaman said.

For small enterprises, the investment criteria has been revised upwards to Rs 10 crore, with the turnover criteria of Rs 50 crore added to the mix, she added.

Enterprises with investment up to Rs 20 crore and turnover up to Rs 100 crore will be termed medium enterprises, Sitharaman said.

Sitharaman announced Rs 3 lakh crores Collateral-free Automatic Loans for Businesses, including Micro, Small and Medium Enterprises (MSMEs).

The collateral-free automatic loan to MSMEs will be given for a four-year tenure with 100 per cent credit guarantee, which will be available till October 31, she said. The scheme will benefit 45 lakh units, allowing them to resume activity and safeguarding jobs, she added.

“To provide stressed MSMEs with equity support, Modi government will facilitate the provision of Rs 20,000 crore as subordinate debt. Two lakh MSMEs are likely to benefit,” Sitharaman said.

The government will provide Rs 4,000 crore to CGTMSE who will provide a partial guarantee to banks who will then give benefit to stressed MSMEs, she said.

Sitharaman announced an additional Rs 50,000 crore equity infusion for MSMEs through Fund of Funds, which will help expand MSME size and capacity.

Announcing further boost to MSMes, Sitharaman said no global tenders will be allowed for government tenders upto Rs 200 crore to enable self-reliant India.

This will allow MSMEs a chance to supply for these big projects and they can be part of government purchases, she added.

Sitharaman said the government will clear all dues to MSMEs within next 45 days and e-market linkage would be enabled for them due to absence of trade fairs and exhibition amidst coronavirus pandemic.

Employees Provident Fund Measures

To maintain cash-in-hand of the employees, the government will pay the employee’s EPF contribution of 12 per cent of plus 12 per cent of the employer’s contribution for another 3 months, Sitharaman said.

She also announced EPF relief measures for all establishments with Rs 2,500 crore liquidity support and added that the government would give employer and employee, 12 per cent contributions.

The relief will be extended for another three months from March-May 2020 to June-August 2020 as well which will benefit nearly 3.6 lakh establishments benefit and 72.22 lakh employees.

“In order to provide more take home salary for employees and to give relief to employers in payment of PF, EPF contribution is being reduced for Businesses and Workers for 3 months, amounting to a liquidity support of Rs 6750 crores,” she said.

Push For Discoms

Sitharaman announced relief measure for cash-strapped and debt-ridden power distribution companies (Discoms). The discoms will get a liquidity infusion of Rs 90,000 crore, which will help them pay off over 95 per cent of their current dues to power generation companies (Gencos).

The entire liquidity infusion will be managed through the two state-run power infrastructure finance giants: Power Finance Corporation (PFC) and REC Ltd, she said.

At present, discoms owe around Rs 94,000 cror to gencose. The situation had worsened since the lockdown, when most industrial demand came to a grinding halt.

The ratings agency ICRA had warned that discoms may face losses of Rs 20,000 crore this fiscal year, with power demand expected to contract.

TDS Cut

To place more funds at the disposal of taxpayers, Sitharaman announced reduction of the tax deducted at source for non-salaried income by 25 per cent of the existing rates along with tax collected at source.

“We think this step will release liquidity of Rs 50,000 crore for people who otherwise would have paid the tax,” she said. The reduced rates will be valid till March 31, 2021.

Under the Indian Income Tax Act of 1961, income tax must be deducted at source as per the provisions of the Income Tax Act, 1961. TDS is deducted for payments of salaries, interest payments by banks, commission payments, rent payments, consultation fees and professional fees. However, individuals are not required to deduct TDS when they make rent payments or pay fees to professionals like lawyers and doctors.

TDS is an advance tax. It is tax that is to be deposited with the government periodically and the onus of the doing it on time lies with the deductor.

Push For NBFCs

To augment liquidity, the goverment came to the aid of Non-Banking Financial Companies (NBFC) struggling to raise funds in debt markets. Sitharaman announced infusion of Rs 30,000 crore under the special liquidity scheme.

Investments, under the scheme, will be made in primary and secondary market transactions in investment grade debt paper of non-banking financial companies (NBFCs), Housing Finance Companies (HFCs) & Microfinance Institutions (MFIs).

The combined total of Rs 30,000 crore support to NBFCs and PCGS of Rs 45,000 crore amounts to total Rs 75,000 crore support for the NBFCs out of the fresh economic package laid out by the Finance Minister towards making India self-reliant.

Other details

An extension of up to 6 months to be provided by Central Government Agencies like Railways, Ministry of Road Transport & Highways, Central Public Works Dept.

On real estate, urban development ministry will issue advisory to states/UTs so that the regulators can invoke force majeure. The regulators can suo moto extend completion/registration dates for six months for projects expiring on or after March 25, 2020.